State Budget is a detailed list of the sources of national income and expenditure allocation within a specified period, usually one year.

Preparation of the budget is based on the principle of balanced and dynamic, meaning that the sector has always endeavored increase state revenues and expenditures in the sector sought savings.

Directing development funds to support activities that increase national production, which amount expenditures (spending) balanced by acceptance.

The detailed preparation of the state budget is based:

a. The principle of balanced and dynamic between revenues with spending

b. Savings are always increasing

c. The increase in tax revenues, intensive and extensive

d. Priority expenditures are important

e. Utilization of natural resources and human resources to the fullest.

Budget function

1. Stabilization function, the budget is expected to maintain stable cash flow and the flow of goods and for the maintenance of a high level of employment, the price level is relatively stable and the rate of economic growth with adequate

2. Allocation function, which may indicate targets and budget priorities and to allocate the factors of production are available in the community, so the community needs for public facilities needs will be met

3. Distribution function, which shows the distribution of funds to the state budget on various sectors

4. The function of economic growth and control inflation, which is through the size of the state budget to increase economic growth and controlling inflation.

The purpose is to guide the state budget revenues and expenditures in carrying out the state to increase production and employment, in order to enhance economic growth and prosperity for the community.

Search

Follow Us On Facebook

Selamat Datang di

dvd

koleksi skripsimu

Menghadirkan koleksi

skripsi yang kami miliki untuk sobat semua yang sedang ataupun akan menyusun

skripsi sebagai syarat lulus untuk meraih gelar strata satu (S1). Koleksi kami

ini lengkap mulai dari cover-Bab1 s/d Bab5 + Daftar Pustaka. Tersaji dalam

format microsoft words (sekitar 90%) dan format PDF (sekitar 10%). Koleksi

skripsi kami dijamin akan membantu penyusunan skripsi sobat.

Darimana

koleksi skripsinya?

Dari hasil bergrilya

ke kampus-kampus, download di internet, minta punya temen kuliah trus yang

terakhir adalah dengan membelinya. Dari jerih payah kami selama ini akhirnya

kami mempunyai koleksi skripsi dari berbagai jurusan dan

universitas-universitas yang ada di Indonesia ini.

NIH

DAFTAR ISI SKRIPSI SEMENTARA

Skripsi Administrasi Bisnis (43 Skripsi)

Skripsi Administrasi Negara (6 Skripsi)

Skripsi Administrasi Niaga (16 Skripsi)

Skripsi Administrasi Pertanahan (10 Skripsi)

Skripsi Administrasi Publik (3 Skripsi)

Skripsi Agama Islam (14 Skripsi)

Skripsi Akuntansi (320 Skripsi)

Skripsi Aqidah Filsafat (14 Skripsi)

Skripsi Bahasa Inggris (28 Skripsi)

Skripsi Bahasa Sastra Inggris (128 skripsi)

Skripsi Biologi (68 Skripsi)

Skripsi Desain dan Komunikasi Visual (31 Skripsi)

Skripsi Ekonomi (251 Skripsi)

Skripsi Ekonomi Islam (196 skripsi)

Skripsi Ekonomi Manajemen (131 skripsi)

Skripsi Ekonomi Pembangunan (28 Skripsi)

Skripsi Elektro (101 Skripsi)

Skripsi Farmasi (73 Skripsi)

Skripsi Fisika (95 Skripsi)

Skripsi Geo Teknik (5 Skripsi)

Skripsi Hukum (175 Skripsi)

Skripsi Hukum Perdata (45 Skripsi)

Skripsi Hukum Pidana (15 Skripsi)

Skripsi Hukum Tata Negara (11 Skripsi)

Skripsi Ilmu Hukum (10 Skripsi)

Skripsi Ilmu Keperawatan (4 Skripsi)

Skripsi Ilmu Komunikasi (12 Skripsi)

Skripsi Ilmu Komputer (95 Skripsi)

Skripsi Informatika (194 Skripsi)

Skripsi Kedokteran (9 Skripsi)

Skripsi Kehutanan (6 Skripsi)

Skripsi Keperawatan (12 Skripsi)

Skripsi Kesehatan Masyarakat (125 Skripsi)

Skripsi Kimia (71 Skripsi)

Skripsi Komputer (37 Skripsi)

Skripsi Komunikasi (67 Skripsi)

Skripsi Manajemen (148 Skripsi)

Skripsi Manajemen Ekonomi (27 Skripsi)

Skripsi Manajemen Keuangan (19 Skripsi)

Skripsi Manajemen Pemasaran (10 Skripsi)

Skripsi Manajemen SDM (38 Skripsi)

Skripsi Matematika (75 Skripsi)

Skripsi Olahraga (75 Skripsi)

Skripsi Pendidikan Agama Islam (32 Skripsi)

Skripsi Pendidikan Bahasa Arab (8 Skripsi)

Skripsi Pendidikan Bahasa Indonesia (69 Skripsi)

Skripsi Pendidikan Bahasa Inggris (109 Skripsi)

Skripsi Pendidikan Biologi (72 Skripsi)

Skripsi Pendidikan Ekonomi (93 Skripsi)

Skripsi Pendidikan Elektro (9 Skripsi)

Skripsi Pendidikan Kimia (96 Skripsi)

Skripsi Pendidikan Matematika (77 Skripsi)

Skripsi Pendidikan Olahraga (164 Skripsi)

Skripsi Perbankan (5 Skripsi)

Skripsi Perbankan Syariah (39 Skripsi)

Skripsi Perkapalan (13 Skripsi)

Skripsi Pertambangan (8 Skripsi)

Skripsi PPKN (69 Skripsi)

Skripsi PGKSD PGSD PGMI (125 Skripsi)

Skripsi Psikologi (140 Skripsi)

Skripsi Sains Kebumian (8 Skripsi)

Skripsi Sejarah (60 Skripsi)

Skripsi Sistem Informasi (46 skripsi)

Skripsi Statistika (68 Skripsi)

Skripsi Sosiologi (19 Skripsi)

Skripsi Syariah (32 Skripsi)

Skripsi Tafsir Hadist (11 Skripsi)

Skripsi Tarbiyah (86 Skripsi)

Skripsi Tata Negara (5 Skripsi)

Skripsi Tata Boga Tata Busana (82 Skripsi)

Skripsi Teknik Elektro (95 Skripsi)

Skripsi Teknik Industri (14 Skripsi)

Skripsi Teknik Informatika (240 Skripsi)

Skripsi Teknik Komputer (13 Skripsi)

Skripsi Teknik Mesin (144 Skripsi)

Skripsi Teknik Metalurgi (9 Skripsi)

Skripsi Teknik Pertanian (14 Skripsi)

Skripsi Teknik Sipil (8 Skripsi)

Skripsi Teknik Telekomunikasi (11 Skripsi)

dll.....

semua kami rangkum dalam 3 kepingan dvd berkualitas

dan jumlah total sementara skripsinya mencapai lebih dari 4.900 buah skripsi (

itung deh kalo gak percaya ^_^)

koleksi

sementara?

Untuk koleksi

sementara kami ada sekitar 4.900 lebih. Lho kok sementara? karena begitu kami

memperoleh skripsi yang baru dan fresh maka kami akan menambahkannya kedalam

koleksi kami sehingga "koleksi skripsi kami akan mengalami penambahan jumlah

tanpa pemberitahuan sebelumnya".

selain skripsi, kami

juga memberikan bonus-bonus yang akan sangat

bermanfaat untuk sobat.

#1 software transtool portable

Ini adalah software

transtool untuk mengubah bahasa Indonesia menjadi Bahasa Inggris

maupun sebaliknya. Sofware ini portable lho so gak perlu instal, simpen z di

flashdisk n tinggal operasikan dimana anda membutuhkannya. Hasil translate

software ini mendekati sempurna sehingga wajar kalo di web aslinya sotfware ini

dihargai Rp 150.000. Tapi di paket koleksi skripsimu akan

kami berikan secara gratis..

#2 software recovery data

Software ini berfungsi

untuk mengembalikan file atau photo yang terhapus dari hardisk ataupun

flashdisk. Semua yang hilang atau tidak sengaja terhapus akan bisa dikembalikan

dengan software yang satu ini dengan keadaan yang tetep baik. Harga dari yang

punya itu adalah Rp 100.000. Tapi di paket koleksi

skripsimu akan kami berikan secara gratis..

#3 Anti virus ringan dan terpopuler

Komputer/laptop anda

akan aman dengan antivirus yang kami berikan di sini. Kaspersky, eset nod32

lalu norman virus control dan semuanya full version siap dijadikan

penjaga data-data anda. Oya satu lagi yang bisa anda pilih adalah avira

antivirus..

#4 PDF creator

Software ini berfungsi

mengubah format microsoft word menjadi pdf, Agar skripsi kamu menjadi lebih

aman dari serangan virus. Harga aslinya mencapai Rp 120.000.

Tapi di paket koleksi

skripsimu akan kami berikan secara gratis..

#5 Ebook rahasia

kok rahasia? ya

karena ebook ini berisi ebook berbahasa indonesia yang tidak beredar luas di

internet. Nilai nominal dari ebook ini lebih dari 1juta lho. Tapi di paket

koleksi skripsimu akan kami berikan secara

gratis..

>> So kami harap

jangan disebar luaskan isinya ya <<

============================================

Pesan sekarang juga!

HARGA SEMUANYA

hanya Rp 120.000,-

HARGA PERJURUSAN

hanya Rp 70.000,-

Skripsi Administrasi Negara (6 Skripsi)

Skripsi Administrasi Niaga (16 Skripsi)

Skripsi Administrasi Pertanahan (10 Skripsi)

Skripsi Administrasi Publik (3 Skripsi)

Skripsi Agama Islam (14 Skripsi)

Skripsi Akuntansi (320 Skripsi)

Skripsi Aqidah Filsafat (14 Skripsi)

Skripsi Bahasa Inggris (28 Skripsi)

Skripsi Bahasa Sastra Inggris (128 skripsi)

Skripsi Biologi (68 Skripsi)

Skripsi Desain dan Komunikasi Visual (31 Skripsi)

Skripsi Ekonomi (251 Skripsi)

Skripsi Ekonomi Islam (196 skripsi)

Skripsi Ekonomi Manajemen (131 skripsi)

Skripsi Ekonomi Pembangunan (28 Skripsi)

Skripsi Elektro (101 Skripsi)

Skripsi Farmasi (73 Skripsi)

Skripsi Fisika (95 Skripsi)

Skripsi Geo Teknik (5 Skripsi)

Skripsi Hukum (175 Skripsi)

Skripsi Hukum Perdata (45 Skripsi)

Skripsi Hukum Pidana (15 Skripsi)

Skripsi Hukum Tata Negara (11 Skripsi)

Skripsi Ilmu Hukum (10 Skripsi)

Skripsi Ilmu Keperawatan (4 Skripsi)

Skripsi Ilmu Komunikasi (12 Skripsi)

Skripsi Ilmu Komputer (95 Skripsi)

Skripsi Informatika (194 Skripsi)

Skripsi Kedokteran (9 Skripsi)

Skripsi Kehutanan (6 Skripsi)

Skripsi Keperawatan (12 Skripsi)

Skripsi Kesehatan Masyarakat (125 Skripsi)

Skripsi Kimia (71 Skripsi)

Skripsi Komputer (37 Skripsi)

Skripsi Komunikasi (67 Skripsi)

Skripsi Manajemen (148 Skripsi)

Skripsi Manajemen Ekonomi (27 Skripsi)

Skripsi Manajemen Keuangan (19 Skripsi)

Skripsi Manajemen SDM (38 Skripsi)

Skripsi Matematika (75 Skripsi)

Skripsi Olahraga (75 Skripsi)

Skripsi Pendidikan Agama Islam (32 Skripsi)

Skripsi Pendidikan Bahasa Arab (8 Skripsi)

Skripsi Pendidikan Bahasa Indonesia (69 Skripsi)

Skripsi Pendidikan Bahasa Inggris (109 Skripsi)

Skripsi Pendidikan Biologi (72 Skripsi)

Skripsi Pendidikan Ekonomi (93 Skripsi)

Skripsi Pendidikan Elektro (9 Skripsi)

Skripsi Pendidikan Kimia (96 Skripsi)

Skripsi Pendidikan Matematika (77 Skripsi)

Skripsi Pendidikan Olahraga (164 Skripsi)

Skripsi Perbankan (5 Skripsi)

Skripsi Perbankan Syariah (39 Skripsi)

Skripsi Perkapalan (13 Skripsi)

Skripsi Pertambangan (8 Skripsi)

Skripsi PPKN (69 Skripsi)

Skripsi PGKSD PGSD PGMI (125 Skripsi)

Skripsi Psikologi (140 Skripsi)

Skripsi Sains Kebumian (8 Skripsi)

Skripsi Sejarah (60 Skripsi)

Skripsi Sistem Informasi (46 skripsi)

Skripsi Statistika (68 Skripsi)

Skripsi Sosiologi (19 Skripsi)

Skripsi Syariah (32 Skripsi)

Skripsi Tafsir Hadist (11 Skripsi)

Skripsi Tarbiyah (86 Skripsi)

Skripsi Tata Negara (5 Skripsi)

Skripsi Tata Boga Tata Busana (82 Skripsi)

Skripsi Teknik Elektro (95 Skripsi)

Skripsi Teknik Industri (14 Skripsi)

Skripsi Teknik Informatika (240 Skripsi)

Skripsi Teknik Komputer (13 Skripsi)

Skripsi Teknik Mesin (144 Skripsi)

Skripsi Teknik Metalurgi (9 Skripsi)

Skripsi Teknik Pertanian (14 Skripsi)

Skripsi Teknik Sipil (8 Skripsi)

Skripsi Teknik Telekomunikasi (11 Skripsi)

dll.....

#1 software transtool portable

#3 Anti virus ringan dan terpopuler

#4 PDF creator

#5 Ebook rahasia

Pesan sekarang juga!

============================================

Mau uang lebih dari 122

juta??

Pertama-tama Kalo ada yang

ngerasa harga segini "kemahalan" perhatiin deh dengan Rp 120.000

kamu sudah mendapat lebih dari 4.900 skripsi. kita anggap saja

4.900 skripsi nah kalo seandainya anda ngejual lagi perjudulnya dengan harga

Rp. 25.000 maka anda akan mendapat penghasilan sebesar 4.900 x Rp 25.000

= Rp 122.500.000 itu kalo jual Rp 25.000

perjudul, kalo jualnya Rp 30.000 atau Rp 50.000 atau malah Rp 100.000 perjudul

gak ada yang ngelarang kok. Dan hasil yang akan anda dapatkan hitung sendiri ya

^_^ Gimana murah kan??

Special BONUS klik logonya

Ayo

order sekarang juga sebelum harganya kami

naikkan karena skripsinya akan terus bertambah jumlahnya,

jadi wajar dong kalo kami menaikkan harganya.

*******************************************************

#1

Sms ke no

0856-6301-745

contoh

isi sms : pesan dvd koleksi skripsimu, Shinta alamat jl. kualadeli no.14

Samarinda + kodepos

sms anda

akan kami balas dan alamat anda akan kami catat. So mohon banget agar alamatnya

lengkap dan jelas.

#2

silahkan transfer ke BRI

Siti Suhermi

2224-01000-494-532

KABAR GEMBIRA !!!!!!!

BAGI SOBAT PEMILIK REKENING SELAIN BRI MAKA BIAYA TRANSFER ANTAR BANK KAMI YANG MENANGGUNGNYA,BERARTI SOBAT CUKUP MENTRANSFER Rp 115.000 UNTUK SEMUA KOLEKSI SKRIPSINYA DAN Rp 65.000 UNTUK PERJURUSANNYA

#3

konfirmasikan via sms

contoh

sms : sudah transfer 120ribu, mohon kirim segera dvd skripsinya.

setelah kami cek transferan anda maka dvd koleksi skripsi akan segera kami kirimkan dan

nomer resi juga akan kami sms kan

>>> GARANSI

!! <<<

DVD koleksi skripsi ini

kami garansi dari kerusakan fisik maupun error. ya walau pun sudah diburn dengan

kualitas yang terbaik namun bisa saja terjadi eror/data tidak terbaca atau

bahkan kerusakan dalam proses pengiriman. So.. tidak usah khawatir akan data error/rusak

karena kami akan kirim dvd yang baru dan tetap gratis ongkos kirim.

### PENUTUP ###

"kami pedagang muslim yang

jujur dan mencari rezeki secara halal. Siapapun yang telah transfer maka demi

Allah dvd koleksi skripsimu ini akan kami kirimkan dan garansi juga akan kami jamin kepastiannya ^_^ "

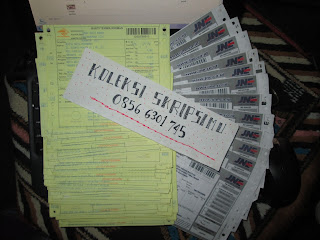

* bukti

pengiriman yang telah kami lakukan

Maaf,

kami tidak mempublikasikan testimoni dari pelanggan kami karena kami

merahasiakan identitas mereka. Tapi kami yakinkan bahwa siapapun yang

telah transfer maka DEMI ALLAH dvd koleksi skripsimu akan kami kirimkan.

Mau uang lebih dari 122 juta??

Special BONUS klik logonya

#1 Sms ke no

2224-01000-494-532

KABAR GEMBIRA !!!!!!!

BAGI SOBAT PEMILIK REKENING SELAIN BRI MAKA BIAYA TRANSFER ANTAR BANK KAMI YANG MENANGGUNGNYA,BERARTI SOBAT CUKUP MENTRANSFER Rp 115.000 UNTUK SEMUA KOLEKSI SKRIPSINYA DAN Rp 65.000 UNTUK PERJURUSANNYA

### PENUTUP ###

Popular Posts

-

Components of A Skripsi or Thesis Written by Ari Julianto Skrips...

-

skripsi manajemen pemasaran pdf - Dan now kita akan membahas menurut bentuk dari proposal skripsi itu. Bentuk proposal skripsi itu terbagi ...

-

Download Games Online

Categories

- Algorima dan Pemrograman Terstruktur

- Award

- Bahasa Indonesia

- Berita

- biologi

- Buku

- Cerpen

- contoh skripsi

- Deskripsi Riset

- download skripsi

- fisika

- Games

- Ilmu Sosial Budaya Dasar

- info

- IPS

- jaringan komputer

- jasa skripsi

- Jenis Riset

- jual skripsi

- Judul Skripsi

- Kata Mutiara

- Kesehatan

- Kewirausahaan

- Langkah Awal

- Latihan Soal UN Online

- LINK

- Lomba

- Materi pelajaran ekonomi

- musik

- olahraga

- Page Rank

- pelajaran bahasa indonesia

- Pelajaran Geografi

- pelajaran seni

- Pem.Web

- Pemahaman

- Pengolahan Instalasi Komputer

- Penting Panas Perlu dan Seruu

- POS UN

- Puisi

- Rancangan

- Sistem Berkas

- Sitem Pendukung Keputusan

- Teknik Optimasi

- Teknologi

- Teknologi Komputer

- tempah skripsi

- Tinjauan

- TOS

- Tugas Adm. Web Lanjutan

- Tugas Bahasa Indonesia

- Tugas Elektronika Digital

- Tugas Sistem Penunjang Keputusan

- Ujian Nasional 2013

BTemplates.com

Blog Archive

- Januari 2019 (15)

- Desember 2018 (403)

- November 2018 (373)

- Oktober 2018 (409)

- September 2018 (387)

- Agustus 2018 (385)

- Juli 2018 (405)

- Juni 2018 (398)

- Mei 2018 (389)

- April 2018 (353)

- Maret 2018 (406)

- Februari 2018 (383)

- Januari 2018 (375)

- Desember 2017 (4)

- Oktober 2013 (81)

- September 2013 (66)

- Agustus 2013 (125)

- Juli 2013 (88)

- Juni 2013 (189)

- Mei 2013 (1434)

- April 2013 (107)

- Maret 2013 (93)

- Februari 2013 (41)

- Januari 2013 (51)

- Desember 2012 (58)

- November 2012 (92)

- Oktober 2012 (40)

- Agustus 2012 (2)

- Juli 2012 (1)

- Mei 2012 (1)

- Maret 2012 (3)

- Februari 2012 (10)

- Januari 2012 (11)

- Desember 2011 (4)

- September 2011 (3)

- Mei 2011 (1)

- Desember 2010 (1)

- November 2010 (1)

- Oktober 2010 (1)

- September 2010 (2)